When you dig deeply enough to understand how financial vehicles work, it’s easy to see their benefits and short-comings. In my educated opinion, it isn’t hard to see just how short mutual funds can fall when used to grow your retirement, family, or personal wealth. Abysmally short, in fact, when applied within the “qualified” 401(k), 403(b), and IRA tax classes. Bedfellows, a term that may have been coined by Shakespeare in The Tempest, conveys the idea that people or things are intimately related; in this case retirement and mutual funds.

First, people are attracted to mutual funds simply because they gain the perceived advantage of having a fund manager; the opportunity to glean the benefit of another person’s experience and much better skill set in the investing arena. Granted, that looks attractive, but “there ain’t no such thing as a free lunch.” You pay, in some cases handsomely, to use another’s investing skill set to grow your wealth. In addition, some fund managers are significantly more skilled than others. Other less-seasoned investors might just “go along” because their information or knowledge of investing is limited, and it’s what everyone else at work is doing! You may in fact be sailing into a headwind!

Once you do a little digging, you find that there are percentage-based sales charges known as loads: sometimes up front, sometimes on the back end when shares are sold. There are also a raft of mutual fund expenses, including: disclosed costs, hidden costs, 12b-1 fees, management fees, reinvestment fees, exchange fees, custodial, and administrative fees. While not all those fees apply to every mutual fund, there will always be fees and a cost to accessing another person’s skill-set; i.e. the fund manager. The referenced articles listed also include costs for tax inefficiency and the “sneaki-ness” involved in running a mutual fund so the numbers on the “glossy brochure” look better to the future prospects!

Once you do a little digging, you find that there are percentage-based sales charges known as loads: sometimes up front, sometimes on the back end when shares are sold. There are also a raft of mutual fund expenses, including: disclosed costs, hidden costs, 12b-1 fees, management fees, reinvestment fees, exchange fees, custodial, and administrative fees. While not all those fees apply to every mutual fund, there will always be fees and a cost to accessing another person’s skill-set; i.e. the fund manager. The referenced articles listed also include costs for tax inefficiency and the “sneaki-ness” involved in running a mutual fund so the numbers on the “glossy brochure” look better to the future prospects!

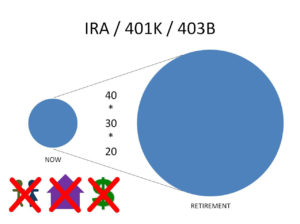

What we’ll look at in this article are the shortcomings of mutual funds, but also the tax category in which most people hold them: the qualified for tax-deferral retirement plans sponsored by the US government and Internal Revenue Service. The short version is: “we’ll forgo taxing you now as long as you set your funds aside for retirement; and then we’ll tax you.” Mutual funds and growing wealth for retirement are strange bedfellows in that those planning for retirement are trying to grow their assets and all the while both the vehicle and the tax classification are working against them!

If you’ve watch my video on the subject, you realize that along with the tax-deferred consideration comes a litany of rules and regulations. Since you aren’t paying current taxes on the money, the government assumes the right to govern how much you can set aside, when you are permitted to access “your wealth”, and what penalties will be applied if you don’t follow the rules.

Here are the relevant details; my comments and reflection will follow the chart, however, my comments will be restricted to part 2: accessible to website members. Website registration is free and takes just a minute for a first name, email address, and state you live in; start HERE. If you are more interested in a free consultation and would like me to consider you as a prospective client, click HERE; I’ll need a few more details about your situation.

IMPORTANT NOTE: In the chart below, read the mutual fund and qualified 401(k), 403(b), and IRA tax classes columns together as a combined set of resulting attributes since most people will own mutual funds inside the tax-classified account types of 401(k), 403(b), and IRAs.

My warm regards for your success,

Access Part 2:

Comparisons:

| Mutual Funds[1] – [2] | 401(k), 403(b), and IRA | IRC 7702 Contracts | |

| Loads and Fees | Front Load: reduces your working capital at purchase by % | Front end sales charges on select account type qualify the client for higher rates of return | |

| Back Load: or “deferred sales charge” % paid when shares are sold | No sales charges account type costs are taken as a percentage, after the returns (work first, eat later) | ||

| Disclosed Costs: average 1.19% | Your 401(k) or 403(b) custodian may assess added fees. | All charges are disclosed by law, and produce measurable client benefits (see leverage below) | |

| Hidden Costs: Average 1.44% | n/a | ||

| 12b-1 fees: Advertising and sales cost | n/a | ||

| Tax Inefficiency Costs: Average 1.10% | Funded with post-tax dollars, both capital and gains can be accessed tax-free. | ||

| Costs of Sneaki-ness: Average 2.49% | n/a | ||

| Optional fees: | Management, reinvestment, exchange, custodial, and administrative fees | Penalties for:

Withdrawal <59-1/2; 10% RMD fail 70-1/2, 50% |

Administrative costs apply, fully disclosed; charges can apply for early surrender (<10-14 yrs) |

| Death benefit equals balance less taxes on gains; no leverage. | Death benefit equals balance less taxes on capital and any gains; estate taxes | Cost of insurance provides tax-free death benefit (est. 5-10x leverage) more than funded | |

| Market risk | Subject to volatility, market manipulation, and trading mistakes | Required investment options keep funds exposed to market risk. | Index tracking removes market risk with a zero percent floor, and guaranteed minimum return |

| Return Rates | Tied to market value, less loads and fees Money market[3] accounts avg 0.0375% | subject to market volatility taxes due at distribution | Track a selected index, or mix:

0-13.5% as a capped option[4] 4.25% margin as uncapped option Fixed Account = 3.75%[5] |

| Income taxes | LIFO – last money in, first money out; capital gains taxes assessed | Funded with pre-tax dollars, all money is taxed at earned income rates, the highest tax rates. | FIFO classification – post-tax capital may be withdrawn first tax-free; full balance and leveraged amounts can be accessed tax-free. |

| Liquidity | Outside qualified accounts, shares sold incur sales and other charges; | Restricted liquidity to age 59-1/2 or with added taxes and penalties | Is 90% liquid at inception for accumulated cash values and becomes 100% liquid post surrender period. |

| Funds can be accessed for

First home purchase Education expenses No penalty, if qualified |

Funds (your personal wealth) can be accessed for any purpose without restriction; can even leverage your account value. | ||

| Additional Features: | Additional coverage at no charge: Terminal, Critical, Chronic Illness leverage to protect your cash value | ||

| Additional strategies for education funding, legacy wealth, and investment funding… |

[1] https://www.forbes.com/sites/kennethkim/2016/09/24/how-much-do-mutual-funds-really-cost/#58b0db6fa527

[2] https://www.ally.com/do-it-right/investing/fees-and-expenses-for-mutual-funds/

[3] Average for deposits $0.01-$10k: https://www.valuepenguin.com/banking/average-money-market-rates

[4] The S&P 500 Point-to-point capped and uncapped options are the most popular among 25-30 or so indexes and tracking methods. Rates are evaluated and reset annually.

[5] Current fixed interest rate for the most popular account type, is evaluated and reset annually.

Many pension funds are not nearly as stable as the participants both think and hope that they are! We can also add this to the above general conversation on mutual funds, the vehicle in which most people put their life and retirement savings.

https://www.silverdoctors.com/headlines/world-news/bankrupt-philadelphia-plunders-its-property-owners-for-cash/